Recently, the idea of controlling electricity tariffs has been promoted in Colombia. For such a measure to make sense, it would be necessary to make a diagnosis of the causes that cause prices to be allegedly high.

For example, identify the congestion problems in the power transmission network to the Atlantic Coast, the high fuel prices of thermal power plants, the high inflation of the general producer price index (IPP), the devaluation, etc.; some of these problems are not related to the country's economic policy and respond to a delicate global situation. Likewise, it is worth investigating the price formation in the wholesale market which, with high water contributions and an energy matrix predominantly based on hydro generation, does not seem to substantially reduce the price of generation, one of the main components of the tariff. Of all these explanations and many more, none of them can be solved by imposing ceilings on tariffs, and there is much that can be done to promote competition.

The liberalization of the Colombian electricity sector has had as one of its main purposes to promote efficiency in the provision of an essential service for society, in a reliable and quality manner. From an economic point of view, in decentralized markets, the regulatory requirement to be efficient is to promote competition (i.e., to mitigate market power). The problem is how to ensure efficient price formation in a market with the characteristics of the electricity market: inelastic demand, market concentration and high storage costs. According to economic theory, all these characteristics facilitate the exercise and potential abuse of market power.

Since the price of electricity in the wholesale market (price spot) is formed on an hourly basis in an auction where generators compete, the bids they make are fundamental determinants of the spot price spot. Therefore, one way to study the strategic behavior of the agents and how they influence the spot price is by studying their bids in this auction. This study, Riascos, Chitiva, Salazar (2022). Anomaly detection and market power in the Colombian electricity sector. Economic Drafts, Banco de la República; a methodology for analyzing the daily bids of all generation resources participating in the wholesale market is proposed. The strategy of studying these offers, prices or energy capacity is common in many competitive and more developed markets than the Colombian one. For example: OFGEM (Great Britain), Nordpool (Scandinavian countries), FERC (United States), NYISO (New York), PJM (Central United States), CAISO (California), etc; and recently recommended in the document CREG-114 of September 10, 2021: Modernization of the Wholesale Energy Market (Binding dispatch, intraday markets and complementary services).

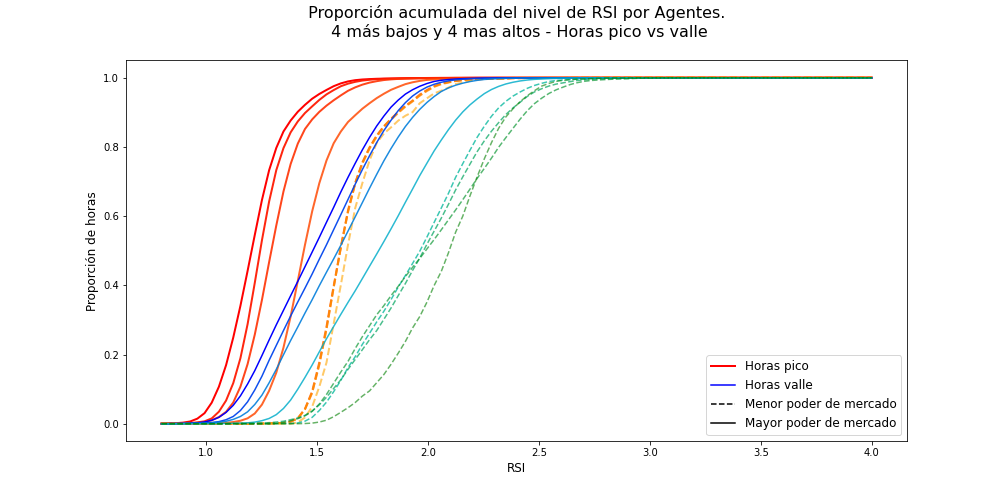

The proposed methodology has two components. First, we use the concept of residual supply index to identify potential resources, plants or agents that by capacity declared the day before the auction, have greater market power. The following figure shows this index for the peak and off-peak hours of the market agents. To understand this figure, the first thing to understand is what is the residual offer index (ROR) of an agent at a specific hour: the total energy capacity declared by all agents, assuming that he withdraws his capacity from the system, as a proportion of the total demand of the system at that hour. Therefore, a residual supply index of 1.2 for an agent at 9PM means that, if the agent withdraws its generation capacity at that hour, the other agents would have the capacity to generate up to 120% of the demand at that hour. Evidently, the lower the residual supply index, the more important the agent is to satisfy demand and potentially, the greater the impact of its strategic decisions.

In the following figure the red lines show the percentage of hours during peak hours (vertical axis) of the four agents with the lowest IOR. As can be seen from these agents, during peak hours, they tend to be quite important for demand satisfaction.

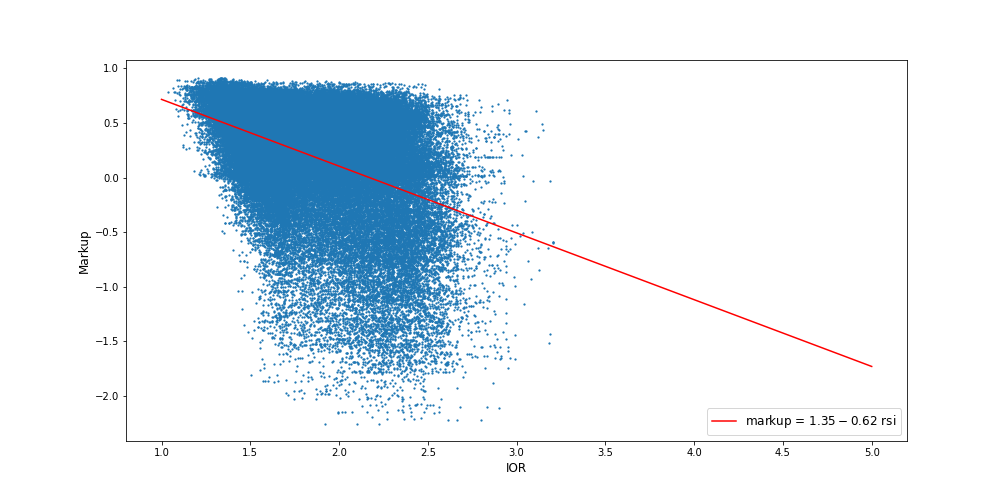

The following figure shows suggestive evidence that there is a negative relationship between markups (market power) and the residual supply index. The figure shows the markups during all hours, for the entire sample and for all resources. In words, the lower the IOR the higher the market power.

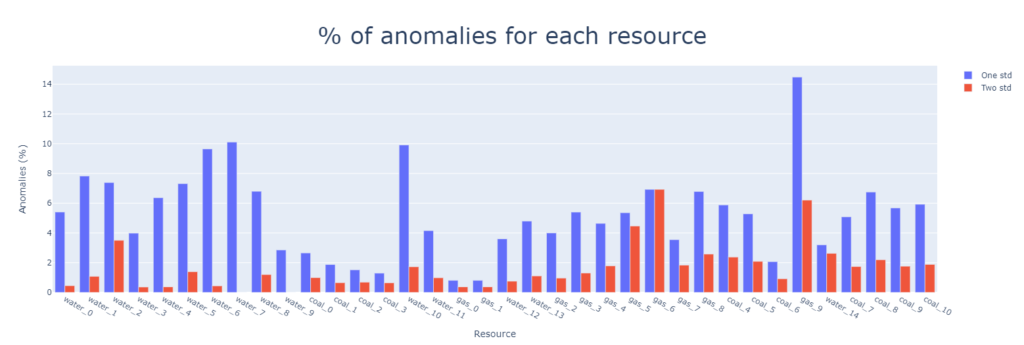

Now, the second component of the methodology is to study statistically the offers of the day before dispatch (i.e., using machine learning methods). The fundamental idea is to build models that allow us to identify offers that are atypical compared to those of other comparable resources in technologies and characteristics that determine the offers of agents such as water inputs, El Niño indicator, time of day, day of the week, etc.

These two steps allow us to generate alerts about resource offers that presumably may be trying to manipulate the market and, in turn, can potentially have a significant impact on the spot price. The figure below shows the percentage of days on which an alert was generated for each resource (when the bid deviation was greater than one or two standard deviations from the best model prediction for that resource).

The application of this methodology identifies, using only the information available from the Colombian electricity system administrator and operator XM S.A.E.S.P. and, prior to the formation of the exchange price (the actual dispatch), those bids that are statistically atypical. It also allows prioritizing alerts. For the latter, the residual offer indicator is used to determine which agents have greater market power and could abuse it by making strategic offers. The next step, once the alert and its relevance are determined, would be to conduct a formal investigation of the alleged anticompetitive conduct and determine penalties if applicable. In advanced electricity markets, the penalty is estimated as the cost of the externality that the participation of that resource imposes on the system (something perfectly feasible for the system operator in Colombia).

In summary, this study introduces a methodology that, exempting the formation of the spot price of energy in the wholesale market, generates alerts of potential market manipulation by a resource or generation plant. Moving in this direction is a smarter strategy in the medium term than imposing tariffs without a good justification.

Get information about Data Science, Artificial Intelligence, Machine Learning and more.

In the Blog articles, you will find the latest news, publications, studies and articles of current interest.