Which auction format, uniform or discriminatory, is more suitable for reducing the government's financing cost?

This debate dates back to the early 1960s, when Milton Friedman advised the U.S. Treasury to adopt the uniform format. However, to this day there is no consensus on which of the two mechanisms is preferable from the issuer’s perspective.

In practice, central banks around the world have shown a clear preference for the discriminatory format. Studies such as that of Bartolini and Cottarelli (1997) found that 39 out of 42 countries used it, and a decade later, Brenner, Galai, and Sade (2007) confirmed that the majority of sovereign issuers maintained that choice.

Among the few exceptions are the United States and Colombia, where public debt auctions are conducted under the uniform format.

In both formats, participants submit a series of bids, each consisting of a price–quantity pair. In other words, each bidder indicates how many units they wish to buy at different prices, where the quantity corresponds to the bond’s face value.

After receiving all the bids, the auctioneer ranks them in descending order and allocates the securities until the planned issuance amount is covered. The fundamental difference between the two formats lies in the payment mechanism after allocation: in the discriminatory format, each participant pays the price they offered, while in the uniform format, all winning bidders pay a single price, known as the cut-off price, which corresponds to the lowest price among the accepted bids.

This distinction, however, opens the debate on which of the two formats yields better results in terms of financing cost. First, a preliminary analysis of both formats does not reveal a clear advantage in favor of either one. In the discriminatory format, the issuer can benefit from price differentiation and, therefore, from higher bids by participants who value the securities more. However, knowing that each awarded unit is paid at the bid price, participants tend to submit more cautious bids in order to avoid overpaying for the allocated quantities.

In contrast, in the uniform format, since all winners pay the same price, bidders can offer prices closer to their true valuation, given that only the cut-off price determines the final payment. However, in return, the issuer forgoes price discrimination and may collect less from investors with a higher willingness to pay.

In this way, determining which of the two formats is preferable amounts to identifying which of these effects carries more weight.

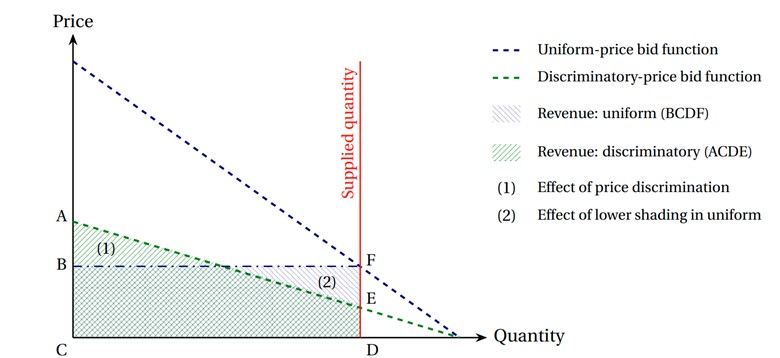

Graphically, as shown in Figure 1, this tradeoff can be represented by the two shaded triangles (1) and (2): the first illustrates the benefit of price discrimination in the discriminatory format, while the second reflects the positive effect of more aggressive bidding in the uniform format.

The comparison between both areas determines which of the two effects dominates and, consequently, which format is more convenient from the issuer’s perspective.

Figure 1.

Since this analysis does not offer a conclusive answer, the need arises for an empirical approach, structured in two main parts.

First, the implicit valuations are inferred from the observed bids. Using data from uniform auctions conducted in Colombia by the Banco de la República and applying the first-order conditions of a model in which agents maximize their expected utility, it is possible to determine, for each bid, the interval within which the valuation that rationalizes it must lie, bounded by an upper and a lower limit.

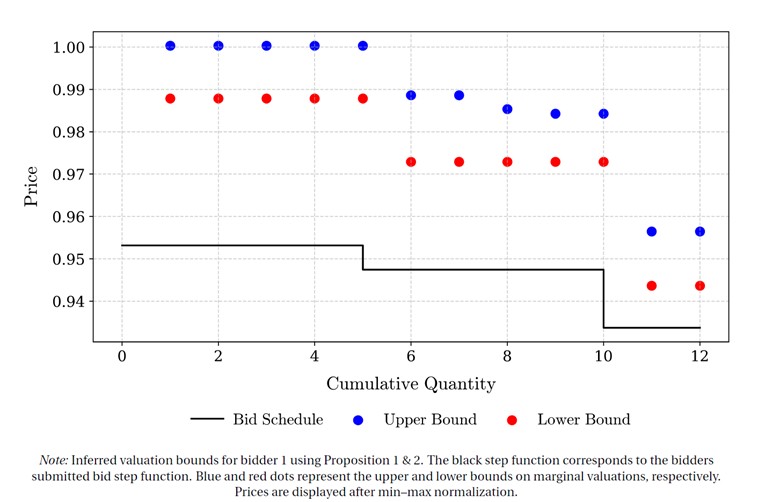

To illustrate the procedure, a specific auction with three participants is selected. Figure 2 presents the result of the valuation inference for one of them. The black line shows the observed bid function, composed of three steps. The blue and red dots represent the upper and lower bounds of the valuation interval that rationalizes each bid.

Figure 2.

By repeating this procedure for all participants, a set of valuation intervals is obtained, from which the surpluses earned by market makers in public debt auctions in Colombia can be calculated (one awarded unit corresponds to one billion Colombian pesos).

Table 1 shows that these agents earn between 27 and 6 basis points of surplus per awarded unit, depending on the quantity acquired.

Table 1.

Once these results are established, the next step is to estimate a symmetric counterfactual equilibrium under an alternative auction format.

Following the methodology proposed by Bichler et al. (2021), this equilibrium is approximated through a single neural network that represents the common strategy for all bidders.

The network defines a mapping function between valuations and bids, receiving as input valuations randomly sampled from those inferred in the previous block (this process is executed separately for the upper and lower bounds) and generating as output the vector of optimal bids corresponding to each set of valuations.

The process is based on simulating a large number of auctions.

In each simulation, agents receive a set of valuations and input them into the neural network, which outputs their corresponding bids.

Once all bids have been submitted, allocations and payments are determined according to the rules of the discriminatory format, allowing for the calculation of each participant’s ex-post utility.

By repeating this procedure multiple times, the average ex-post utilities are obtained, which constitute an estimate of expected utility.

The network parameters are iteratively adjusted to maximize this average expected utility, so that the model converges toward the optimal symmetric strategy.

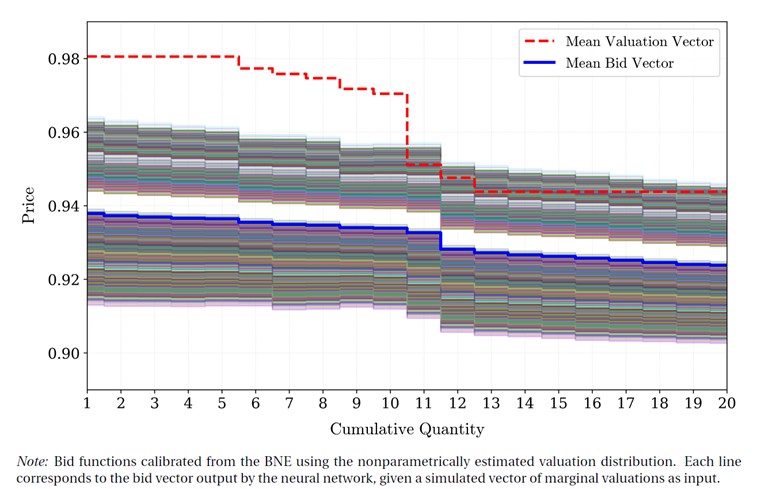

To visualize the calibrated network, valuations are simulated and the vector of optimal bids produced by the network is graphed, along with the average vectors of valuations and bids highlighted.

Figure 3.

With the neural network calibrated, the final step is to once again take the valuations inferred in the first block and use them to generate the counterfactual optimal bids under the discriminatory format.

This exercise produces two scenarios: one associated with the upper bound and another with the lower bound of the estimated valuations, which together define the counterfactual range of possible outcomes.

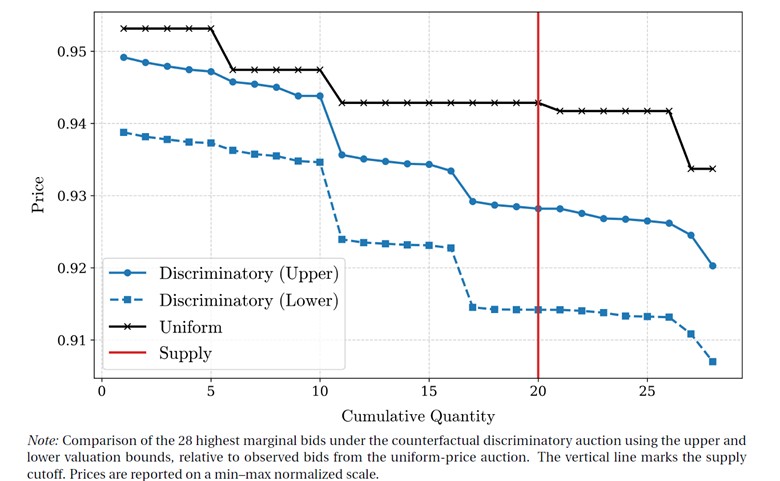

Subsequently, all observed bids from the original auction are combined with the counterfactual bids corresponding to each bound and ranked from highest to lowest, as shown in Figure 4.

Since 20 units are awarded in the analyzed auction, the 20 highest bids determine the winning allocations in both formats.

Figure 4.

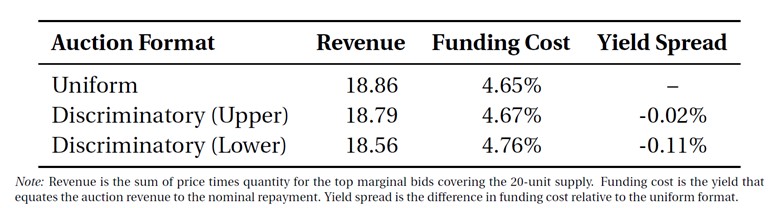

Finally, Table 2 reports the total revenue obtained by the issuer in each case and, based on that, the corresponding financing cost.

Table 2.

The results, presented in Figure 4 and Table 2, show that implementing a discriminatory auction instead of the uniform format would have increased the financing cost by at least two basis points.

Although the difference is small, its cumulative effect over multiple auctions can translate into considerable fiscal savings.

While in the analyzed auction the uniform format appears to be the most advantageous, these results are not universal, as they may vary depending on the specific conditions of each auction, such as the number of participants, the level of competition, or the amount offered.

In this regard, the next natural step is to extend the analysis to a broader set of auctions and periods in order to assess how these factors influence the comparison between formats.

Get information about Data Science, Artificial Intelligence, Machine Learning and more.

References

Bichler, M., Fichtl, M., Heidekrüger, S., & Wolf, D. (2021). Learning equilibria in symmetric auction games using artificial neural networks. Nature Machine Intelligence, 3, 687–695.

Hortaçsu, A., & McAdams, D. (2010). Mechanism choice and strategic bidding in divisible good auctions: An empirical analysis of the Turkish treasury auction market. Journal of Political Economy, 118(5), 833–865.

McAdams, D. (2008). Partial identification and testable restrictions in multi-unit auctions. Journal of Econometrics, 146(1), 74–85.

In the Blog articles, you will find the latest news, publications, studies and articles of current interest.