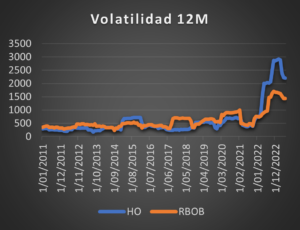

Today, the monthly volatility of a gallon of gasoline is $2,000. That is, a "normal" movement would be between a fall of $2,000 and a rise of $2,000. Today the FEPC cushions these movements, but if in the future it is left free against the international price, as announced by the Minister of Finance, we could be looking at a completely different situation. Is the country prepared for this? What can companies do? What can individuals do? In our blog, we discuss the current situation with the FEPC and the costs and benefits of abandoning it.

Recently, the Minister of Finance stated that, once the international price of gasoline is reached, it will be tied and will remain floating against the market. Although most countries live a similar floating price reality (even self-sufficient countries such as Mexico), Colombia has not experienced this situation since the creation of the FEPC (Fuel Price Stabilization Fund) in 2007, so an explanation may help to understand its importance.

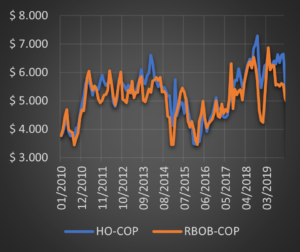

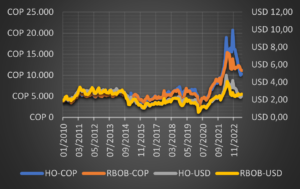

The price of financial assets, such as the price of gasoline and diesel, fluctuate every month, traded under leading indices such as the RBOB or Heating Oil, at different terms (1, 2, 3, 6, ..., 24 months) in US dollars. Thus, it is natural for an oil industry to tie itself to this type of index, since moving away from them may leave it (i) out of the market if its selling price is higher or (ii) at a loss compared to the international price, which would be against the interests of its shareholders.

To cushion the volatility of the dollar and international indexes, the FEPC was created to introduce a regulated price, which every month would move - maximum - 2.8% in either direction, seeking to approach - slowly - the international price. In principle, the fund was to be self-sustaining, since, in times of low international prices, the regulated price would be above - generating a surplus for the nation -, while, in times of high prices, the regulated price would be below - generating a deficit.

To cushion the volatility of the dollar and international indexes, the FEPC was created to introduce a regulated price, which every month would move - maximum - 2.8% in either direction, seeking to approach - slowly - the international price. In principle, the fund was to be self-sustaining, since, in times of low international prices, the regulated price would be above - generating a surplus for the nation -, while, in times of high prices, the regulated price would be below - generating a deficit.

In analyzing the data, however, significant challenges could be foreseen. In particular, when international crude oil prices fall sharply, the peso tends to devalue at a similar rate. This negative correlation dampens the impact on the international price, causing times of low prices to generate a small surplus. However, when prices rose rapidly, the effect on the peso was small, so that the deficit was

significant. Thus, the movements of 2015-2016 and 2020-2021 led to significant deficits that today have the FEPC with historically low prices.

With the elimination of the regulated price, new challenges are coming for the country's fuel consumers (particularly the transportation sector). In particular, looking at the 2015-2016 period, as in the figure above, the price in pesos has been little volatile in the face of the drop in oil prices in 2015, because it was accompanied by a 50% devaluation of the exchange rate.

Today, however, we are experiencing significant growth that has not been accompanied by the expected revaluation in exchange rate (although in dollars, today the price is at comparable levels with 2018).

A natural way to measure the effect is the volatility of monthly changes, which could be interpreted more intuitively as what would be a "normal" movement in a month. During 2011, monthly volatility hovered around COP$300-COP$350, while today that value is at COP$2000. In other words, if before a normal month, the price of gasoline or diesel could move about COP$300 per month, today a normal movement would be COP$2,000 per month. This represents the negative side of linking ourselves to the international price: even in times of greater calm, we could be anticipating movements of $300 every month (in either direction), while in times of stress, we should not be surprised by movements of $2,000.

A natural way to measure the effect is the volatility of monthly changes, which could be interpreted more intuitively as what would be a "normal" movement in a month. During 2011, monthly volatility hovered around COP$300-COP$350, while today that value is at COP$2000. In other words, if before a normal month, the price of gasoline or diesel could move about COP$300 per month, today a normal movement would be COP$2,000 per month. This represents the negative side of linking ourselves to the international price: even in times of greater calm, we could be anticipating movements of $300 every month (in either direction), while in times of stress, we should not be surprised by movements of $2,000.

In Colombia, the insurance culture (through foreign exchange and gasoline hedges) has not been widely adopted. Thus, the elimination of the international price presents one of the main challenges in terms of culture: to migrate to a private insurance culture, where agents measure risk and make hedging decisions with the objective of reducing volatility and uncertainty. The benefits of this are clear: it improves planning, eliminates or reduces dependence on international prices and protects the company in periods of stress. At Quantil, we have been helping companies to manage these risks for 15 years in different sectors - hydrocarbon, retail, automotive, transportation, agriculture, to name a few.

In conclusion, abandoning a regulated price represents a paradigm shift in the behavior of Colombian prices to which we are not accustomed. Likewise, those who have the possibility of accessing derivative markets may contemplate this approach as a solution to the problem, but it should not be forgotten that individuals do not have access to a hedging market and have less possibility of reacting. If today it seems to us that increases of $600 pesos are abysmal, we cannot yet imagine a scenario where $1,000 pesos is a quiet month.

Get information about Data Science, Artificial Intelligence, Machine Learning and more.

In the Blog articles, you will find the latest news, publications, studies and articles of current interest.